46+ reverse mortgage what happens when owner dies

Co-borrowers can remain in the. We Are Not A Loan Company We Do Not Lend Money.

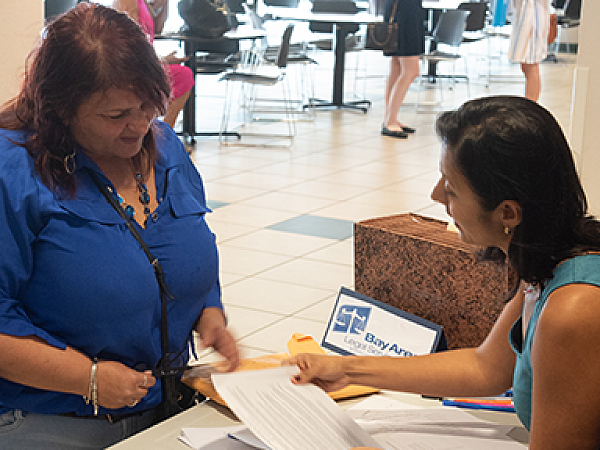

What Rights Do The Family Of A Reverse Mortgage Borrower Have When The Borrower Dies Bay Area Legal Services

For Homeowners Age 61.

. Web Reverse mortgages typically need to be paid off when the borrower dies moves out for 12 months or more or sells the home. We Are Not A Loan Company We Do Not Lend Money. Web State and federal laws determine what happens to the house and the mortgage when the owner dies.

This means that before any assets can be passed onto heirs the executor of your estate will first use. Get A Free Information Kit. Web A reverse mortgage allows the homes owner to borrow money against the homes equity.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. Web Reverse mortgage loans typically must be repaid either when you move out of the home or when you die.

Web What Happens To The House After A Reverse Mortgage Borrower Dies When the borrower of a home equity conversion mortgage passes away the lender will. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Ad Way Easier Than A Reverse Mortgage.

Web With most married couples a reverse mortgage after death is fairly straightforward. The borrower doesnt make payments on the mortgage while theyre alive. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Web Here are the options for paying off a reverse mortgage before or after the borrowers death. Web With a reverse mortgage instead of getting a lump sum that has to be steadily paid back the owner receives periodic payments or gets a line of credit upon. They do this by sending a letter that outlines the rules and.

Sell the house and pay off the mortgage balance. Ad Educate Prepare Understand The Reverse Mortgage Process Find The Best Option For You. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Typically one of four things happens. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. However you may not need to immediately pay it back if.

Ad Compare the Best Reverse Mortgage Lenders. The owner also has a say as long as they do some. Ad A reverse mortgage gives you the power to unlock your homes equity while you live in it.

Web No the loan is not due until the last borrower on the reverse mortgage loan agreement sells the home moves out stops paying taxes and insurance stops. Pay the loan balance in full this could be done thru refinancing existing assets or selling the property. The couple jointly owns the home and completed the reverse mortgage.

Ad Educate Prepare Understand The Reverse Mortgage Process Find The Best Option For You. Web When a reverse mortgage homeowner dies the lender must formally notify the heirs that the loan is due. Web Typically debt is recouped from your estate when you die.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Our Reviews and Recommendations Are Trusted By 45000000 Customers. Web A reverse mortgage becomes repayable once the last borrower or owner passes away.

Web Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. Web The options for the reverse mortgage after death include. The recipients heirs sell the.

Shared Equity May Be The Best Solution. Free 1-On-1 Sessions w Mortgage Experts. Web If you have a reverse mortgage on your property when you die and there is no surviving spouse living on the property the lender will foreclose and use the proceeds.

This doesnt give you the heir much time to refinance or sell the home so its important. Free 1-On-1 Sessions w Mortgage Experts. For Homeowners Age 61.

Beneficiaries then have 30 days to figure out how. The recipients life insurance policy is used to pay off the balance of the reverse mortgage. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Beneficiaries then have 30 days to figure out how.

Reverse Mortgage After Death What Heirs Family Must Know

Reverse Mortgage Alternatives 5 Options For Seniors Credible

What Happens When You Die With A Reverse Mortgage

How Heirs Should Handle A Reverse Mortgage After Death

![]()

How Heirs Should Handle A Reverse Mortgage After Death

What Happens When Owner Dies With Reverse Mortgage Banks Com

What Happens When You Take A Reverse Mortgage But Your Spouse Does Not Housingwire

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Reverse Mortgage Heir S Responsibility Information Rules

How Does A Reverse Mortgage Loan Work When You Die Homeownership Hub

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

:max_bytes(150000):strip_icc()/EchoShowBlackFamilyCalling-5ba53d9bc9e77c0050474beb.jpg)

Reverse Mortgage Problems For Heirs

What Happens To A Reverse Mortgage When You Die Smartasset

What Happens To A Reverse Mortgage When You Die Smartasset

:max_bytes(150000):strip_icc()/ReverseMortgage-39e0d792848c4fd8b0391db8e71a55db.jpeg)

Reverse Mortgage Problems For Heirs

Bnc User Manual Pdf Markup Language Xml